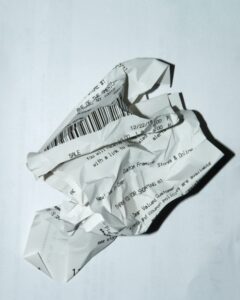

Did you know that you should keep complete records for taxes for 7 years? Did you know that a lot of receipts these days are printed on thermal paper that fades with time? Can you imagine being audited and opening your shoe box full of receipts and finding many of them have turned into blank slips of paper? In order to keep these receipts so that they are useful years later you need to make digital copies. The IRS will accept digital copies of receipts. You can snap a picture with your cell phone and upload to a Google Drive or something similar. If you are using QuickBooks Online for your bookkeeping you have the option to attach them to the transaction in the software. This makes is so easy to find what you are looking for and have a complete record of all your expenses! If you are interested in learning more about how to keep those receipts organized digitally, schedule a free consultation call!

Did you know that you should keep complete records for taxes for 7 years? Did you know that a lot of receipts these days are printed on thermal paper that fades with time? Can you imagine being audited and opening your shoe box full of receipts and finding many of them have turned into blank slips of paper? In order to keep these receipts so that they are useful years later you need to make digital copies. The IRS will accept digital copies of receipts. You can snap a picture with your cell phone and upload to a Google Drive or something similar. If you are using QuickBooks Online for your bookkeeping you have the option to attach them to the transaction in the software. This makes is so easy to find what you are looking for and have a complete record of all your expenses! If you are interested in learning more about how to keep those receipts organized digitally, schedule a free consultation call!